tax sheltered annuity definition

Tax-Sheltered Annuity is a retirement annuity plan for employees of tax-exempt organizations and public schools to make contributions from hisher income. Ad Read the Other Advantages a Deferred Annuity Provides How You Can Benefit from One Today.

Taxsheltered Annuity Plans Also Known As 403b Plans

The tax sheltered annuity is a deferred tax arrangement expressly granted by Congress in IRC Section 403 b.

. A type of retirement plan under Section 403 b of the Internal Revenue Code that permits employees of public educational organizations or tax-exempt organizations. This link for present value future value ordinary is still working Perfect picture with future value ordinary life You may want to see this. Ad Annuities Is a Resource for Consumers Doing Research for Their Retirement Planning.

While times have changed and 403b plans can now offer mutual funds as noted many still. Read About Deferred Annuities Today. A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income.

A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. The employee is not taxed on the contribution until heshe begins to make. Tax-Sheltered Annuity TSA is a form of retirement savings plan in which the contributions made are from the income that has not been taxed and therefore the contributions and interest.

Ad Annuities are often complex retirement investment products. A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way. 20 Years Experience Providing Expert Financial Advice.

These organizations can set up a TSA. Ad Learn More about How Annuities Work from Fidelity. Its similar to a 401 k plan maintained by a for-profit entity.

This annuity plan is also known. A retirement plan in which an employee makes tax-deferred contributions from hisher pre-tax income. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Tax sheltered annuities for employees of Section 501 C 3 organizations. Tax Sheltered Annuity Definition search trends. Ad Read the Other Advantages a Deferred Annuity Provides How You Can Benefit from One Today.

Read About Deferred Annuities Today. The most common tax-sheltered investments. A tax-deferred annuity TDA commonly referred to as a tax-sheltered annuity TSA plan or a 403 b retirement plan is a retirement savings plan available to employees of.

Tax-sheltered annuity TSA A retirement plan that permits an employee of a tax-exempt charitable educational or religious institution to contribute a certain portion of wages or. Learn some startling facts. Ad Learn More about How Annuities Work from Fidelity.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. Understanding Deferred Annuities Can be Confusing. A tax-sheltered annuity TSA is a retirement plan for non-profit organizations such as schools hospitals charities and churches.

Understanding Deferred Annuities Can be Confusing. Also known as a tax-sheltered annuity a 403b plan is an employer-sponsored plan designed for employees of certain tax-exempt organizations eg hospitals churches charities and. A tax-sheltered annuity TSA also referred to as a tax-deferred annuity TDA plan or a 403 b retirement plan is a retirement savings plan for employees of certain public.

When the 403b was invented in 1958 it was known as a tax-sheltered annuity.

Withdrawing Money From An Annuity How To Avoid Penalties

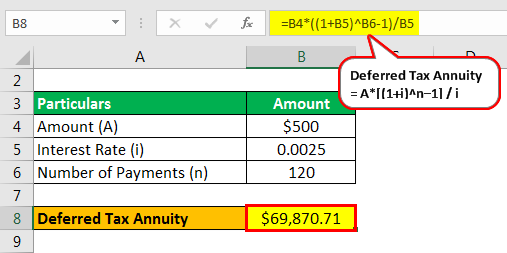

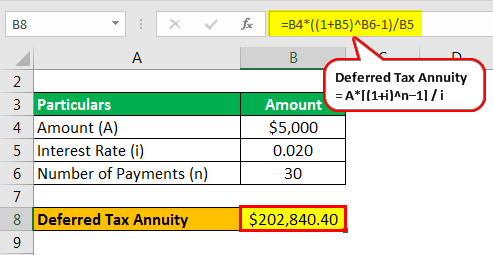

Tax Deferred Annuity Definition Formula Examples With Calculations

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Tax Sheltered Annuity Faqs Employee Benefits

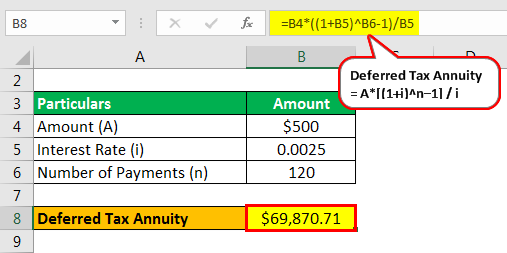

Introduction To Annuities Ppt Download

What You Should Know About Tax Sheltered Annuities The Motley Fool

The Minnesota State Colleges And Universities System Is An Equal Opportunity Employer And Educator Mnscu Retirement Plans Basic Training For Campus Hr Ppt Download

The Hierarchy Of Tax Preferenced Savings Vehicles

Tax Deferred Annuity Definition Formula Examples With Calculations

The Tax Sheltered Annuity Tsa 403 B Plan

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download

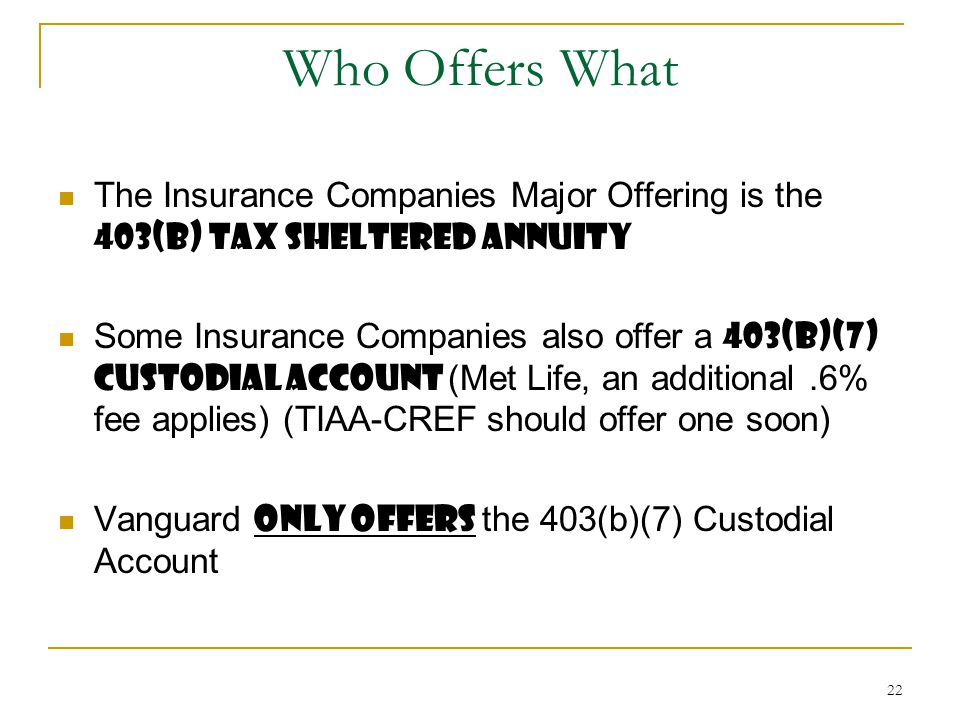

Request For Disbursement Form Tax Sheltered Annuities

Metlife Resources Mlr Certification Training Ppt Download

Annuity Lifetime Income Later Safety Guarantees Magi

Tax Deferred Annuity Definition Formula Examples With Calculations